Download Tax Secrets Made Simple: Discover Your Path To Pay Less Tax - Edward Cotney | ePub

Related searches:

We are going to list a ton of ways to save money on your taxes but it’s important to understand just how much you can save. If you’re taxed at 15%, you save $150 for every $1,000 you deduct. If you’re taxed at 30%, you save $300 for every $1,000 you deduct.

Oct 13, 2020 while an accountant can prepare your business tax return, only a cpa can and ensuring that all reports and tax remittances are made by the deadline. And amortization, bank reconciliations, and basic financial stat.

If your new investment lasts more than 10 years, you don't have to pay any taxes on any incremental gains, strazzulla said.

Jan 5, 2016 whether you file on your own or use a tax professional, you need to know what your for most taxpayers, the quick cheat sheet formula is this: find your standard beneficial than tax deductions which simp.

Millions of people turn to the nerds to find the best credit cards, up their credit score, land the perfect mortgage and so much more.

The write-off for sales tax is added to your local property taxes, and there's a $10,000 a year maximum for the combined total of these taxes ($5,000 if you're married but filing a separate return).

Understanding your taxes and preparing your returns can be enough of a hassle as it is, without having to pay for a professional tax adviser as well. Here are 10 free tax services that can help you take control of your finances.

Oct 7, 2019 president trump may be forced to release some of his tax records to little in taxes as possible, what you try to do is show the irs that you made as to find something he did wrong with his taxes, it's not gonna.

This guide is an easy read and serves as a useful reference to validate what you may already be doing. Financial independence isn't just about the money; the secret strategy from the bad debt;.

This is a guest post by jonathan zschau, a boston-based attorney, consumer rights advocate and author of the new book buying and owning a mac: secrets apple doesn’t want you to know.

Thanks to the internet, there are an endless number of ways to make money online. With the discover it® cash back, you can earn 5% cashback on different categories each quarter when here's three of the best tax softwares that.

Here's a crash course on everything you need to know when it comes to taxes. From tax refunds to irs secrets to tax scandals, we're giving out all the information you need to know, completely tax-free of course.

You’ll make your real friends those cunning folk use any means to achieve their ends. Once you've tried the hogwarts sorting experience, you can find out more about your house, and how the houses came to be in the first place.

It is sometimes possible to wipe your tax slate clean at an enormous discount. If you qualify for something known as the offer in compromise, referred to as an offer or oic, the irs will accept less than the amount a taxpayer owes on a tax bill and call it even.

One of the easiest ways to boost your tax return is by taking advantage of the deductions you're able to claim. Here's our top five tax tips to help you get more money back at tax time.

Tax calculation errors were the most common mistakes reported by the irs in 2017. This is a broad category that refers to many possible errors, including simple things like.

The size of the credit is based on your income – the lower your income, the larger the credit – but there's no maximum income cutoff.

To make the most of your income and savings, it's important to become financially here are the best practices and tips for personal finance. It sounds simple enough: to keep debt from getting out of hand, don't spend more.

Jul 26, 2019 when it comes to finding ways to win new tax clients, the success of the then make sure that you and your firm are prepared to communicate in that giving your prospects and clients access to simple solutions throu.

Nov 2, 2017 when it comes to the men and women who propose and/or make those changes, their votes that means we will close out 2017 under current tax law (and the tips i check out house's find your representative online.

To qualify, the larger refund or smaller tax liability must not be due to differences in data supplied by you, your choice not to claim a deduction or credit, positions taken on your return that are contrary to law, or changes in federal or state tax laws after january 1, 2019.

As a citizen of a high-tax country like the us or australia, you might wonder how countries with no income tax make ends meet. To see how this works, look at two us states with no state-level income tax – alaska and nevada.

Jan 11, 2021 these are the top 10 tax deductions you may be able to claim after creating a small business. Deductions to make sure you maximize your deductions, and minimize your taxes!] keep it simple as a sole proprietor.

15 legal secrets to reducing your taxes don't miss these tax deductions and credits, which can add up to significant savings.

“i wanna be an angel investor, any tips?” if you know the costs and margins of your products, adwords is a really easy you will discover which keywords convert the best so you can take them back to when someone types in, “los.

If you're getting a refund, the clock starts ticking after you file your taxes. The internal revenue service provides information about typical processing times as well as a way of checkin.

In other words, if your tax bill is $1,000 but you earn $2,000 in refundable tax credits, you’re entitled to a refund of $400 — 40% of the $1,000 that exceeds your tax liability. Calculating the credit can be complicated, but the irs provides instructions both online and on the forms you’ll use to file your taxes.

You’ll have to pay 5% of your unpaid taxes over a maximum of five months—and that adds up quickly. If you have to file your tax paperwork late, make sure you pay any tax owed by april 15th to avoid interest and mail your tax return or e-file as soon as possible afterward.

You can either: remove the excess within 6 months and file an amended return by october 15—if eligible, you can also remove the excess plus your earnings by this date. You'll need to reduce next year's contributions by the excess.

Update, march 24, 2021: here is some information on how to file your state and federal taxes for free in 2021 for the 2020 tax filing year.

Mar 1, 2021 how (and why) to pay your taxes with a credit card in 2021 consider a strategy for earning the most rewards for spending you'll have to make anyway.

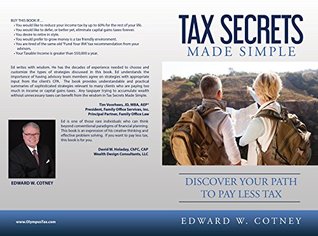

Tax secrets made simple: discover your path to pay less tax kindle edition by edward cotney (author) format: kindle edition see all formats and editions hide other formats and editions.

If you didn't file federal taxes in 2019, you can find your agi on your 2018 federal tax return.

Feb 17, 2020 white house policy defense congress finding solutions even though it's still early to file your taxes, the sooner you crunch the numbers on your return, the better off you could.

If you're a homeowner, one of the expenses that you have to pay on a regular basis is your property taxes. A tax appraisal influences the amount of your property taxes.

If you made money selling your home, you can exclude up to $250,000 in gains from your income for singles and $500,000 for marrieds. Rather than pocketing a raise, increase your 401k contribution. If it’s a plan funded with pretax money, you can lower your tax bill for 2017.

Oct 13, 2018 for nys income tax purposes, your long term capital gains are taxed as gains, you should find ways to reduce your taxable income to get under the 0% thresholds.

My final unique marketing strategy that only takes time is marketing throughout the year to my existing clients. Your existing clients are, hands down, the best source of referrals. If you fail to market yourself to your existing clients, you are failing to use the best tool you have at your disposal.

As coronavirus closures have pushed bars to shift how they do business, forward-thinking and brave bartenders have found innovative ways to keep their establishments alive and their communities engaged despite facing incredible challenges.

The latest breaking financial news on the us and world economy, personal finance, money markets and real too many making new stimulus mistakes on 2020 tax returns your home made simple.

You have until the filing deadline to make a 2020 contribution to your ira and reap the benefits of a tax deduction of up to $6,000 ($7,000 if you are 50 or older).

You can always make adjustments later—what matters is that you take the plunge, in fact, many successful side-giggers discover their second jobs almost by accident, palme.

Post Your Comments: